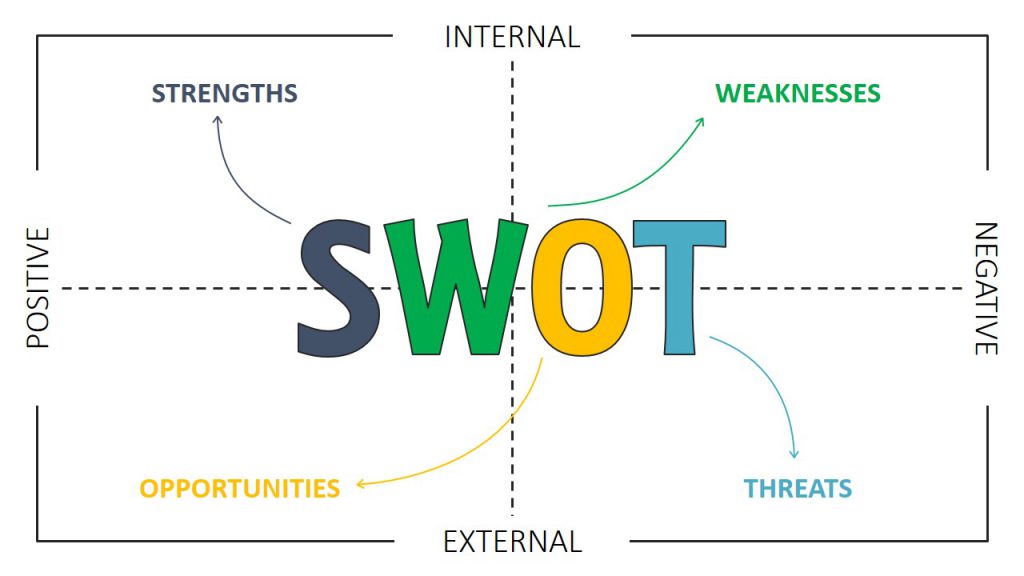

What is the SWOT evaluation of the hydroflight industry? The image is of a SWOT table Strengths, Weaknesses, Opportunities and Threats. These evaluations are used to study how to improve a business or a company. In this example, we’ll look at the hydroflight industry and make our assessment as a discussion starting point.

Let’s start with the positives.

Strengths: The sport is dynamic, fun, easy to learn and challenging to progress one’s abilities. Hydroflight is the safest form of personal flight. All ages can participate, and a low level of physical exertion required means that it can be practiced just as easily by men and women, young and old. People with disabilities can be guided into the experience. Hydrosport is to watch and can be practiced in bodies of water available everywhere. The sport is relatively new and remains attractive to alliances with other brands for promotional possibilities.

Opportunities: Increased growth for tourism and resort rentals. Civil Defense uses such as firefighting. Possible search and rescue and well as security. Amusement park attractions, shows. Corporate team building. Flight centers and incorporation into school programs. Hydroflight summer camps.

Weaknesses: Industry size is miniscule and growth has leveled off. Industry infighting limits the growth of competitive structure. Market opportunity awareness has peaked. High cost of market entry. Perceived difficulty, the majority of observers assume there is a high level of difficulty and risk. As the small group of experienced riders builds their riding level, the center of communication is high level riding, this can put off the possible new entrants. Requires a jet ski or external pump and related energy costs. Due to the industry scale and entrenched “talent”, has difficulty attracting world class individuals in media, development, promotion, etc.

Threats: Global economy. Coastal or inland water regulations. Taxes and tariffs. Injuries and negative press. Inferior equipment. Race to the bottom in pricing. Shortsightedness of players offering product direct at low margins. Venture capital companies dumping product into a small market.